Risk is an inevitable companion in the dynamic world of business and professional services. From ancient merchants safeguarding their ships from storms to modern enterprises battling data breaches, the ability to manage risk is crucial for survival and growth.

Failing to address potential threats can result in significant financial losses and damage a company’s reputation. To ensure long-term success, organizations must adopt a thoughtful and adaptable risk mitigation strategy. This article will explore the various types of risks businesses face and outline effective strategies to mitigate them.

What is Risk in Business?

Risk is the inherent uncertainty associated with business operations, which can lead to various forms of loss, which aren’t always financial. They can also include damage to reputation, legal complications, operational disruptions, and security breaches.

Financial risks

Financial risks encompass the uncertainties faced by a company related to its financial operations, which could potentially impact its profitability. These may include fluctuations in exchange rates, changes in interest rates, or the risk of clients defaulting on payments.

Legal or compliance risks

Legal or compliance risks are the potential legal penalties and sanctions a business might face due to non-compliance with regulations and laws. To mitigate these risks, it’s critical to stay informed about relevant legislation and adopt compliance as an integral part of your business strategy.

Implementing regular employee training and establishing clear, straightforward compliance guidelines will also help reduce the risk of legal complications.

Operational risks

Operational risks involve potential failures in a company’s day-to-day activities, from internal processes and systems to human errors. Addressing these requires a detailed risk assessment followed by the development of robust risk mitigation strategies that focus on process improvement, employee training, and possibly the adoption of new technologies.

Mitigating operational risks effectively improves efficiency and productivity, contributing positively to the company’s overall performance.

Security risks

Security risks, particularly in the digital realm, pose a significant threat to businesses of all sizes. These risks can range from data breaches and cyberattacks to physical security threats.

To mitigate these risks, companies should invest in comprehensive security systems, conduct regular security assessments, and ensure that all employees are trained on security best practices.

Reputational risks

Reputational risks can devastate a company’s brand and customer loyalty, often as a result of negative publicity or poor customer experiences. Companies must actively manage their reputation by monitoring public perception and responding swiftly and effectively to any crises that might arise.

Adopting a customer-first approach and ensuring transparent communication are essential strategies for mitigating reputational risk.

What is Risk Mitigation?

Risk mitigation is a proactive process of identifying, evaluating, and addressing potential risks that could negatively impact a business. It’s a crucial part of any risk management strategy, as it focuses on minimizing the probability and impact of adverse events.

Step 1: Identify Risks

Risk mitigation begins with identifying potential risks that a business may face. This involves a thorough risk assessment to understand the various risks in the financial, legal, operational, security, and reputational domains. Identifying risks early is critical because it sets the stage for developing strategies to manage or eliminate these risks.

It’s a proactive approach that involves gathering data, analyzing historical incidents, and foreseeing potential future challenges that could impact the business.

Step 2: Rate and Prioritize

After identifying potential risks, the next step is to rate and prioritize them based on their likelihood and potential impact on the business. This involves assessing each identified risk to determine its severity and the urgency with which it needs to be addressed.

High-impact risks that could severely disrupt business operations or cause financial loss are given top priority. This step is crucial for efficient resource allocation, ensuring that time and effort are focused on mitigating the most critical risks first.

Step 3: Create a Plan and Mitigate

With a clear understanding and prioritization of risks, the next step is to create a comprehensive risk mitigation plan. This plan outlines the specific steps and measures that will be taken to manage or eliminate the identified risks. It involves selecting the appropriate risk mitigation strategies, such as avoidance, acceptance, transference, or reduction, and detailing how these strategies will be implemented.

This plan’s development is a collaborative effort, requiring input from various business stakeholders to ensure its effectiveness and practicality.

Step 4: Monitor and Review

Monitoring and reviewing the effectiveness of the risk mitigation strategies and plan is a continuous process. It involves regularly assessing the evolving risk landscape and the effectiveness of the implemented measures. This step ensures that the risk mitigation strategies remain relevant and are adjusted in response to new threats or changes in the business environment. Constant vigilance and adaptability are key in effectively managing risks over time.

The Goal of Risk Mitigation

The ultimate goal of risk mitigation is to minimize the negative impacts of risks on a business. This involves implementing strategies that reduce the likelihood of risk occurrences and lessen their potential impact on the company’s operations, finances, and reputation.

A successful risk mitigation process supports a company’s long-term stability and growth, enabling it to navigate uncertainties with greater confidence. By systematically identifying, assessing, and addressing risks, businesses can protect their assets, ensure regulatory compliance, and uphold their reputation, thus securing a competitive advantage in the market.

What is a Risk Mitigation Plan?

A risk mitigation plan is a strategic document that outlines how an organization will address and manage the risks it has identified as potential threats to its operations. It systematically details the measures and actions that will be taken to reduce or eliminate risks, specifying who will be responsible for implementing these strategies and when.

A comprehensive risk mitigation plan covers all facets of risk, including financial, legal, operational, security, and reputational risks, providing a clear roadmap for effectively mitigating them.

Why is Risk Mitigation Important?

Risk mitigation is crucial for the sustainability and growth of any business. It equips companies with the strategies and tools needed to navigate the uncertain and volatile business environment effectively.

Through a well-constructed risk mitigation plan, businesses can anticipate potential challenges, minimize disruptions to operations, and reduce financial losses, thus securing their long-term success and stability.

Risk mitigation’s importance lies in its ability to protect a company’s assets, reputation, and stakeholder relationships, which are vital components of business success.

The Process of Identifying Risk

Identifying risk is the foundational step in risk management. It involves the systematic detection and documentation of potential risks that could negatively impact the business.

This step requires a thorough examination of the business environment, both internal and external, to uncover vulnerabilities, uncertainties, and threats. Identifying risks is pivotal as it informs the development of strategies to mitigate these risks, ensuring the business is prepared to handle potential challenges effectively.

The Best Risk Mitigation Strategies for Your Business

1. Risk Acceptance

Risk acceptance is a strategic decision to acknowledge risk and choose not to take mitigative action against it, often because the cost of mitigating the risk outweighs the potential impact.

This strategy is commonly employed for low-impact risks where the resources required to mitigate the risk are better allocated elsewhere. It involves continuous monitoring of the risk to ensure that it remains within acceptable levels.

Acceptance is a viable strategy in risk management, emphasizing the need for businesses to prioritize and focus their mitigation efforts where they can have the most significant impact.

2. Risk Transfer

Risk transfer involves shifting the potential impact of a risk to a third party, usually through insurance or outsourcing. This strategy is particularly effective for risks that are beyond the company’s expertise to manage or would have a significant financial impact.

By transferring the risk, companies can protect themselves against substantial losses, ensuring that they are better positioned to focus on their core operations.

Risk transfer is a critical component of a comprehensive risk management plan. It offers a way to handle unavoidable or unpredictable risks.

3. Risk Avoidance

Risk avoidance is a proactive strategy that involves altering plans or business practices to completely avoid the risk. It’s typically used for risks with potentially severe consequences that cannot be effectively mitigated through other means.

While risk avoidance can protect the business from significant threats, it may also limit opportunities for growth. Therefore, this strategy must be carefully considered, weighing the potential benefits of avoiding the risk against the possible costs of missing out on opportunities.

4. Risk Reduction

Risk reduction involves implementing measures to decrease the likelihood and/or impact of a risk. This strategy is commonly used when the risk cannot be completely avoided but can be minimized through proactive steps.

Examples include enhancing security measures to reduce the risk of theft or implementing safety protocols to minimize workplace accidents.

5. Risk Buffering

Risk buffering is a strategy that involves creating buffers or cushions to absorb the impact of a risk should it materialize. This could take the form of financial reserves, excess inventory, or additional resources allocated to a project to account for potential delays or challenges.

By building these buffers into their planning, businesses can ensure they have the flexibility and resources to respond to unexpected events without significantly disrupting their operations.

6. Risk Strategizing

This strategy involves creating a comprehensive plan to address potential risks. It encompasses identifying and assessing risks, developing mitigation measures, and establishing clear procedures for responding to incidents. A well-defined risk strategy ensures that all stakeholders understand their roles and responsibilities in managing and minimizing risks.

7. Risk Testing

Risk Testing focuses on simulating potential risk scenarios to assess their impact and test the effectiveness of mitigation plans. This can involve stress testing financial models, conducting cybersecurity drills, or running tabletop exercises to prepare for operational disruptions.

8. Risk Quantification

Risk Quantification aims to measure the potential impact of risks in quantifiable terms, such as financial loss, operational downtime, or reputational damage. By assigning numerical values to risks, businesses can prioritize mitigation efforts and allocate resources more effectively. Risk quantification often involves using statistical models and data analysis to estimate the probability and severity of potential events.

9. Risk Digitization

In the digital age, businesses are increasingly reliant on technology, making them vulnerable to cyberattacks, data breaches, and system failures. Risk digitization involves using digital tools and platforms to identify, assess, and manage risks related to technology infrastructure and data security. This can include implementing security software, conducting regular vulnerability assessments, and developing incident response plans.

10. Risk Diversification

This strategy involves spreading risk across multiple areas or investments to reduce the impact of any single event. In business, this might involve diversifying product lines, entering new markets, or working with multiple suppliers. By not relying on a single source of income or resource, businesses can better withstand unexpected disruptions and maintain stability.

How to Mitigate Risk Using Project Management Tools

Project management tools are invaluable assets in mitigating operational risks within organizations. They offer features that streamline processes, enhance communication, and provide transparency, all of which contribute to reducing the likelihood of errors, delays, and miscommunications.

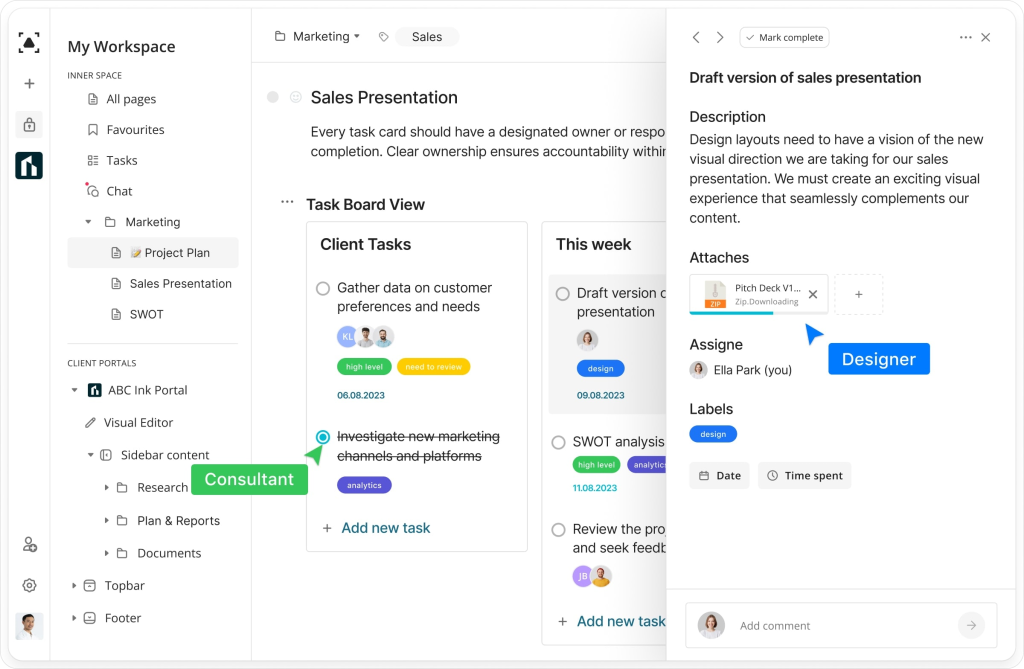

Adopting Task Management

Task management software like client portals enables teams to break down complex projects into smaller, manageable tasks. This approach promotes clarity and accountability, as each task can be assigned to specific individuals with clear deadlines. The software allows for real-time tracking of task progress, making it easy to identify potential bottlenecks or delays early on.

Additionally, task management tools often include features like prioritization, dependency management, and resource allocation

By utilizing these features, project managers can ensure that tasks are completed in the most efficient order, that resources are allocated effectively, and that dependencies between tasks are clearly defined.

This level of organization significantly reduces the risk of tasks falling through the cracks or being completed out of order, both of which can lead to project delays and cost overruns.

Monitoring Project Progress

Project management tools offer robust monitoring and reporting capabilities, providing stakeholders with a clear view of project status. Real-time dashboards, Gantt charts, and progress reports allow for quick identification of deviations from the project plan. This enables proactive intervention to address issues before they escalate into major problems.

Client portals, in particular, offer clients direct access to project updates, fostering transparency and trust. This open communication channel allows clients to provide feedback and raise concerns promptly, further mitigating the risk of misunderstandings or unmet expectations.

Conslusion

Risk is an inherent part of doing business, but with a well-thought-out risk mitigation strategy, businesses can navigate uncertainties and emerge stronger. By proactively identifying, assessing, and addressing potential threats, organizations can protect their assets, reputation, and bottom line. Embracing a culture of risk awareness and implementing the appropriate mitigation strategies will empower businesses to thrive in an ever-changing world.